One Nevada Credit Union was founded over 70 years ago with a mission to be the trusted provider of superior financial solutions for our Member-owners, with excellence in member support. They currently have 1.33 billion in assets and serves 75K members in Washoe, Clark, and Nye counties.

One Nevada Credit Union prides itself on being a technology-focused credit union because “we understand that the best technology enables us to deliver the best service to our members,” said Jesse Shearin, Vice President of Information Technology at One Nevada Credit Union. With technology leading the way, One Nevada saw a pathway to upgrading its capabilities for the member experience.

Updating and Upgrading

More than 20 years ago One Nevada implemented touch tone IVR for phone banking. When the topic came up to upgrade the technology after a core conversion to Symitar, the One Nevada team broached an IVR update. Especially since the legacy voice system no longer aligned with its mission.

Challenges

- No “smart” 24/7 service option for members, even though Las Vegas runs 24/7

- Agents spent a lot of time clearing straightforward questions

- Not enough time to spend on relationship building and driving revenue growth

- Finding the right partner alignment

The team knew there was anxiety about members who were using the old IVR system, which was still averaging a thousand calls a day. Ultimately they pushed forward with Conversational AI to make a significant difference on behalf of members.

- The older system hadn’t gotten a significant change in decades

- The IVR was limited and offered only 10 functions

- It was like a time capsule of old technology surrounded by One Nevada’s upgrades

- Their members are tech-savvy so they had to keep pace with their needs

The decision was made to replace the old IVR with Posh's Voice Assistant in March 2021. Fast forward to June 2023, One Nevada added another Posh product, the Digital Assistant. Staring with their website, they are quickly expanding the chatbot to online banking and mobile platforms.

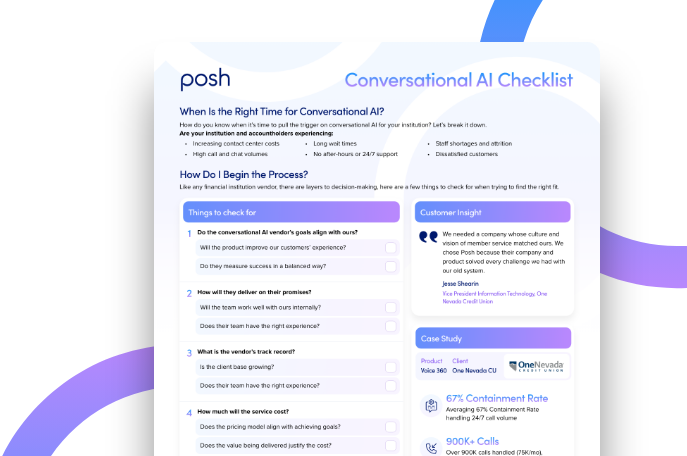

Why Posh

“We needed a company whose culture and vision of member service matched ours,” Shearin said. “We chose Posh because their company and product solved every challenge we had with our old system.”

Setting the Stage for Sage

The project was an organization-wide effort. One Nevada was determined to make sure it wasn’t siloed to only certain parts of its organization to maximize success.

The project was collaborative, and the Contact Center, Marketing, and Mortgage departments were involved. Tasks were assigned, such as content reviews and testing efforts to external departments.

Meet Sage

“Looking back, I can say that one of the most important keys to our success was naming the bot and having all our employees participate in the naming process,” Shearin said. “I’m very proud of what we ended up with.”

The name is something both members and employees resonated with. They wanted a name that was Nevadan. The Sagebrush is Nevada’s state flower and the bot would be very wise.

Nevada + Wisdom = Sage

Answering the Call

With Sage at the frontline of One Nevada, answering questions expeditiously (and wisely), members saw a shift in service.

Results:

- 1.3M+ interactions and counting

- 24/7 member service

- 20% reduction of calls to the Contact Center

- 20% reallocation of Contact Center staffing needs

- Contact Center closure on Sundays due to an 80% reduction in volume

- 67% containment rate

- 70K savings per month

The Sage Experience

Previously, the old IVR didn’t answer questions, it routed callers to humans who had to answer those questions even if they were basic.

- The contact center was not a 24-hour operation but Las Vegas is. The switch allowed One Nevada to better meet the needs of the unique demographic.

- From day one it was already a significant upgrade compared to the previous system, and over 12 months has only gotten better with machine learning and fine tuning.

- It maintains a fast pace for dealing with members.

“This isn’t the finish line. We are still meeting with Posh on a regular basis to add new features and improve the bot,” Shearin said. “The bot really has evolved a lot since we launched and we expect that to continue.”

Event -

Client Story: One Nevada Credit Union

Are you attending and interested in learning more?

Register today

Visit event page to learn moreEmail info@posh.ai for the recording!

September 1, 2022

2:22 pm

Virtual event

Event Details

Speakers

No items found.